Ivane Javakhishvili Tbilisi State University

Paata Gugushvili Institute of Economics International Scientific

FINANCIAL CONTROLLING AS A TOOL FOR EFFECTIVE ENTERPRISE MANAGEMENT

Abstract. The article defines the essence of the "controlling" concept and the preconditions for its occurrence. The correlation of controlling components within the enterprise management system is presented. The discussion defines the essence of financial controlling. The functions of financial controlling are presented. The comparative characteristic of operational and strategic financial controlling is presented. The principles that must be taken into account when building a financial controlling system are identified. The stages of financial introduction controlling in the system of sustainable management development of the enterprise are presented. The ways of improving the financial system controlling are given.

Keywords: controlling, financial controlling, sustainable development, management, functions, enterprise, effective management.

Formulation of the problem. Modern conditions of enterprises functioning require the management to make the most effective management decisions, to ensure the competitiveness of the enterprise in the realities of today. As you know, the basis of sustainable development of the enterprise is to ensure the financial development of the company, that is why financial controlling is one of the main factors for the effective functioning of the enterprise. Therefore, the lack of an objective assessment of the present and future financial position of the enterprise may lead to the adoption of irrelevant decisions that could lead to the bankruptcy of the enterprise. That’s why, the introduction of financial control system allows timely detection of deviations in financial performance, which will efficiently take steps to adjust the activity of the company.

Analysis of recent publications. Today, research in the field of controlling, especially financial control, is increasingly being conducted. The research of theoretical and practical aspects of financial controlling is devoted to the work of many scientists, in particular: Prokopets L.V. [1], Tsigilik I.I., Mozil O.I., Kirdyakina N.V. [2], Radziwill I.V., Silina I.V. [4], Veliky Y.M., Kosaraeva I.P., Bagirova A.D. [5], Mayevskaya J.V. [7], Berbar M.M. [8], Golovko O.G., Kirilo O.R. [9] and others.

The purpose of the article is to study the nature and features of financial controlling as a tool for effective management of an enterprise in the modern conditions of its operation.

Presenting main material. In the modern management system, controlling is a rather recent phenomenon that has emerged at the intersection of such economic areas as: planning, economic analysis, management accounting and management. In terms of strategic and operational goals, controlling takes the enterprise to a whole new level, correlating the activity of all major divisions of the enterprise.

The term itself originated in America, in the 1970s it migrated to Western Europe and in the early 1990s to Ukraine. In the definition, the term combines two components: controlling as a philosophy and controlling as a tool:

controlling is the philosophy and way of thinking of managers, focused on the effective use of resources and the development of the enterprise (organization) in the long run;

controlling - goal-oriented integrated system of information-analytical and methodological support for executives in the planning, control, analysis and adoption of management decisions in all functional areas of the enterprise [1].

The necessity for the appearance of modern enterprises such a phenomenon as controlling, can be explained by the following reasons:

–– increasing environmental instability puts additional demands on the enterprise management system;

–– shift of emphasis from the control of the past to the analysis of the future;

–– increasing the speed of reaction to changes in the environment, increasing the flexibility of the enterprise;

–– the need for continuous monitoring of changes occurring in the external and internal environment of the enterprise;

–– the need for a thoughtful system of actions to ensure the survival of the enterprise and avoid crises;

–– the complexity of enterprise management systems requires a mechanism of coordination within the management system;

–– universal - striving for synthesis, integration of different spheres of knowledge and human activity [2].

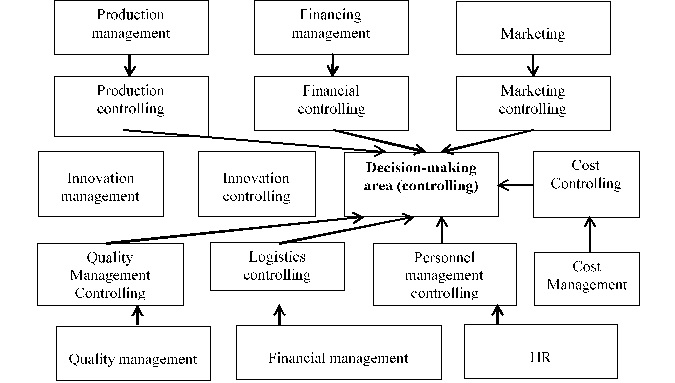

Analysis of the scientific literature has shown that some scientists consider controlling as a complex tool in the enterprise management system, that is, not dividing it into components. Another group of scientists studies aspects of controlling through the lens of its constituent elements (production control, financial control, marketing control, innovation control, cost management control, quality management control, material security, personnel control). In Fig. 1. the ratio of components of controlling within the enterprise management system is presented.

Fig. 1. The ratio of components of controlling within the enterprise management system [3].

One of the most important components of controlling is financial controlling, which allows you to make effective decisions on financial management, which is the key to a positive trend of sustainable development of the company. Let's take a closer look at the nature and features of financial controlling.

So I.V. Radzivilo, I.V. Silina in their scientific work "Conceptual principles of financial controlling at the enterprise" very successfully consider the essence of definition of the concept of "financial controlling", based on the discussions of various scientists (Table 1).

Table 1

Discussion of the essence of financial controlling

|

Author |

Definition |

Benefits of definition |

Disadvantages of definition |

|

Gogua N.K. |

Financial controlling is an important element of the overall controlling system and differs in the focus and scope of the activity covered. |

integration of financial controlling into the enterprise controlling system. |

there is no detail of the components of financial control of the enterprise. |

|

Godes O.D. |

Financial controlling is a controlling system that provides concentration of control actions on the most priority areas of financial activity of the enterprise, timely detection of deviations of its actual results from the ones envisaged and making prompt management decisions ensuring its normalization. |

the precisioness of the components of financial control at the enterprise. |

unclear access to financial control at the enterprise. |

|

L.O. Kovalenko, L.M. Remnyova |

Financial Controlling is a self-regulating system of methods and tools aimed at functional support of financial management in an enterprise by concentrating controlling actions in the main areas of managing its finances, revealing deviations of actual values of control indicators from normative and taking operative measures to normalize the process of financial management. |

emphasis on managing the company's finances. |

timeframes of financial controlling are not understood. |

|

Yu.S. Lauta, B.I. Gerasimov |

Financial Controlling is a management system that ensures concentration of management and control actions on priority areas of financial activity of an entity, identifying deviations from its actual results from those envisaged and making operational management decisions that ensure its normalization or optimization. |

Emphasis on the relationship between financial control and management. |

timeframes of financial controlling are unclear. |

|

G. Partin, Y. Mayevskaya |

Financial controlling is the art of management (management system), aimed at determining the future financial well-being of the enterprise and ways to achieve it |

Emphasis on the relationship between financial control and management. |

there is no detail of the components of financial control of the enterprise. |

|

O.V. Ryabenkov |

financial controlling is a functional system of financial management support, which involves the integrated use of methods and tools of budgeting, planning, internal control, information support and risk management to assess the overall financial condition of the enterprise, timely detection of deviations from the planned indicators and prompt response to the influence of negative factors and their timely neutralization in order to ensure a positive long-term effect. |

detailing the components of financial controlling. |

no connection with controlling at the enterprise. |

|

M. Khristenko |

Financial control should be considered in a complex way, simultaneously in several planes: formal, functional and substantive, which can present it in many ways. |

comprehensive approach to financial control. |

there is no detail of the components of financial control of the enterprise. |

Source: author-based source [4]

For a deeper understanding of the essence of financial controlling and its role in the enterprise management system, the functions of financial controlling were presented, which were successfully and maximally systematized in the scientific work of Velykyi Y.M., Kosaraeva I.P., Bagirov A.D. "Interpretation of the concept of" financial controlling "and disclosure of its essence" [5]. Therefore, the functions of financial controlling include:

- supervision of the realization process of financial tasks established by the system of planned financial indicators and standards;

- measurement of actual results deviation degree of financial activities from the projected ones;

- diagnostics of the deviation size of serious deterioration in the financial enterprise state and a significant decrease in the pace of its financial development;

- development of operational management decisions on normalization of the enterprise financial activity in accordance with the envisaged goals and indicators;

- adjusting, if necessary, individual goals and indicators of financial development due to changes in the external financial environment, financial market conditions and internal conditions for conducting business activities of the enterprise.anned financial indicators and standards;

- coordination; financial strategy; planning and budgeting;

- budgetary control;

- internal consulting;

- methodological support;

- internal audit;

- audit;

- forecasting;

- financial analysis;

- financial control;

- risk assessment;

- early warning system;

- analysis of financial deviations;

- supervision of the fulfillment of financial tasks, which is regulated by the system of financial norms and indicators;

- diagnostics of serious deviations of financial condition indicators of the enterprise and a significant decrease in the pace of its financial development;

- development of operational management decisions for the normalization of the financial activity of the company;

- adjustment of certain indicators due to changes in the external financial environment, financial market conditions and internal conditions for conducting business activities of the enterprise;

- obtaining, managing and using financial resources.

By target, financial controlling is divided into strategic and operational. Strategic financial control means a set of functional tasks, tools and methods of long-term (three years or more) financial, cost and risk management. Operational financial controlling is focused on the achievement of short-term quantitative targets set within the framework of the developed strategic plans. Operational financial controlling focuses on the achievement of profit, cost, return on equity and more. The objectives of strategic and operational financial control should be consistent and their achievement should be constantly monitored and coordinated by the appropriate controlling services. Table 2 provides a clarified comparative characteristic of strategic and operational financial control, which is developed on the basis of generalization of existing theoretical developments in financial control and based on work [6].

Table 2

Comparative characteristics of operational and strategic financial control

|

The comparison criterion |

Strategic Financial Controlling |

Comparative characteristics of operational and strategic financial control controlling |

|

1. Orientation |

External environment, adaptation of the enterprise |

Efficiency of internal processes at the enterprise |

|

2. The level of planning |

Strategic planning |

Tactical and operational planning, budgeting |

|

3. Tasks |

Definition of strategic goals and development of financial strategy of the enterprise; identification and formation of strategic success factors and ensuring long-term competitiveness; definition of horizons of financial planning, formulation of target methodology of strategic and operational planning at the enterprise in accordance with established horizons; implementation of an effective early warning and response system; long-term management of the value of the enterprise to ensure the growth of shareholders' well-being; ensuring the integration of long-term strategic goals and operational goals for individual employees and structural units |

Establishment of planned operational indicators of financial and economic activity of the enterprise; reporting; timely provision of information on deviations from actual targets; analysis of the causes of deviations, preparation of alternative decisions and recommendations for elimination of negative deviations; provision of internal consulting services |

|

4. Targets |

Chances / Risks Strengths / Weaknesses |

Revenues / expenses Cash Receipts / Cash Expenses |

|

5. Sources of information for decision making |

External and internal sources of information |

Internal sources of information |

|

6. Tools |

Enterprise Strength and Weakness Analysis (SWOT Analysis), Portfolio Analysis, Early Warning and Response System (EWRS), Benchmarking, Target Costing, ABC Analysis (Activity Based Costing), Functional Value Analysis |

ABC analysis (to identify key points and priorities in an enterprise's activity), XYZ analysis, order volume optimization, CVP analysis (Cost-Volyme-Profit), budgeting, financial performance analysis |

Therefore, we see the strategic importance of introducing controlling into the enterprise management system given the above, which will not only achieve the goals of the enterprise in the form of profit, but will allow the enterprise to grow dynamically and continuously.

The following principles must be taken into account when building a financial controlling system:

1) the focus of the financial controlling system on achieving the financial strategy of the enterprise;

2) multifunctionality of financial controlling;

3) focus of financial controlling on quantitative indicators;

4) compliance of financial control methods with the specific methods of financial analysis and financial planning;

5) timeliness, simplicity and flexibility of financial control system construction;

6) economic efficiency of introduction of financial control at the enterprise [7].

In accordance with the introduction of financial controlling in the system of sustainable development management of the enterprise distinguish the following stages:

1. Diagnosis of financial and economic activity of the enterprise.

2. Deciding on the introduction of financial control service at the enterprise.

3. Develop a budget for the implementation of financial controlling.

4. Development of operational and strategic goals related to production, finances and investments, with priority setting.

5. Development and justification of methods and tools of financial control to the specific activity of the enterprise.

6. Creation of a comprehensive information support system.

7. Evaluation of the effectiveness of the control service.

8. Improvement of financial controlling in the system of management of sustainable development of the enterprise [8].

Today there is a problem of inactivity of the controlling system at many enterprises. This indicates the inability of the controlling tools to cope with the tasks. Therefore, Golovko O.G., Kirilo O.R. offer the following ways to improve the financial control system:

1. Reduced time for information submission and decision making. The company should switch to monthly comparison of planned and actual performance indicators, as well as to keep a separate record of the state of affairs at the enterprise in order to be able to make the necessary decisions on a daily basis, based on the current state of affairs.

2. Transparency and reliability of data. In order for the financial control system to be improved, it is necessary that the digital data is true.

3. Introduction of information technologies. There are two ways of implementing information technology: 1) automation of their own efforts, that is, the development of their own software product that would fully take into account the specificity of the enterprise, information needs of managers. But it is too expensive for domestic enterprises; 2) cheaper and easier way - to introduce an information system, which has a special module "controlling", which will facilitate the provision of information - from business planning to analysis of business results.

4. Strategic planning. Implementation of strategic controlling, which on the basis of planning will allow to predict different phenomena and processes.

5. Organization of the controlling service. Although most companies cannot afford to expand their staff, the final stage in improving the financial control system is to set up a financial controlling service. This service may be organized individually at each enterprise, for example, at one enterprise, functions may be performed by one controller and at the other by interconnected departments (economic analysis, planning and internal accounting departments can, in fact, solve the controlling problem by using it methodology) [9].

Conclusions. Thus, the analysis of the essence of financial controlling, presented in the work, allows to conclude that financial controlling affects all areas of activity of the enterprise. It is a comprehensive and systematic tool that enables the effective functioning of the enterprise, ensuring its sustainable sustainable development. Financial controlling is interconnected between enterprise management subsystems through audit, analysis, planning, and more. Thanks to an effective system of financial controlling it is possible to achieve the most efficient response to external and internal changes that affect the sustainable development of the enterprise.

References

- Prokopecj L.V. Kontrolingh jak instrument upravlinnja pidpryjemstvom / L.V. Prokopecj / Ekonomika ta upravlinnja pidpryjemstvom. 2019. Vyp. 39-2. S. 17-20.

- Cyghylyk I.I., Mozilj O.I., Kirdjakina N.V. Kontrolingh v systemi upravlinnja. Aktualjni problemy ekonomiky. 2015. # 3. S. 117–123.

- Kontrolingh jak nova koncepcija upravlinnja. [Elektronnyj resurs]. – Rezhym dostupu: http://www.iib.com.ua/default.asp?cid=156&lang=1.

- I. V. Radzivilo, I. V. Silina Konceptualjni zasady finansovogho kontrolinghu na pidpryjemstvi. [Elektronnyj resurs]. – Rezhym dostupu: http://www.economy.nayka.com.ua/pdf/11_2015/45.pdf

- Velykogho Ju.M., Kosarajevoji I.P., Baghirova A.D. «Traktuvannja ponjattja «finansovyj kontrolingh» ta rozkryttja jogho sutnosti» / Ju.M. Velykyj, I.P. Kosarajeva, A.D Baghirov / Ghroshi, finansy i kredyt. 2019. Vyp. 31. S 585-589.

- Merenkova L.O. Finansovyj kontrolingh jak systema efektyvnogho upravlinnja pidpryjemstvom. [Elektronnyj resurs]. – Rezhym dostupu: http://www.economy.nayka.com.ua/?op=1&z=5147

- Majevsjka Ja. V. Vydy ta misce finansovogho kontrolinghu na pidpryjemstvi / Ja. V. Majevsjka // Naukovyj visnyk NLTU Ukrajiny. – 2009. – Vyp. 19. – S. 47–52.

- Berbar M.M. Finansovyj kontrolingh jak skladova systemy upravlinnja stijkym rozvytkom pidpryjemstva / M.M. Berbar // Investyciji: praktyka ta dosvid. 2017. # 18. S. 33-37.

- Gholovko O.Gh. Osoblyvosti vprovadzhennja systemy finansovogho kontrolinghu na vitchyznjanykh pidpryjemstvakh / O.Gh. Gholovko, O.R. Kyrylo // Visnyk Universytetu bankivsjkoji spravy Nacionaljnogho banku Ukrajiny. 2013. # 1 (16) S.259-262.